Features

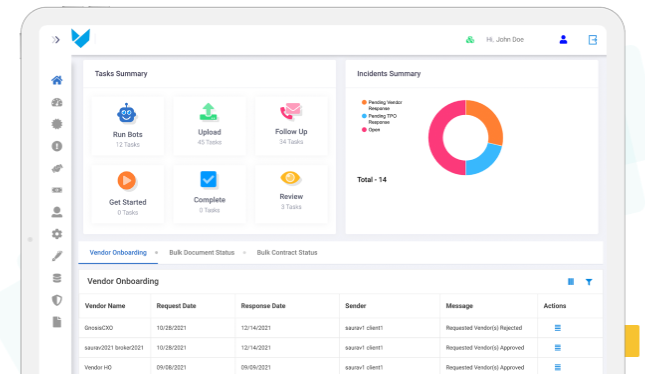

Vendor Management

Key Benefits

- Centralized repository for all your vendors and third-party service providers.

- Redundancy and resilience – Leverage our large network of vetted vendors.

- Seamless vendor onboarding, vetting and maintenance.

- Dedicated, trained and experienced professionals for implementing added oversight practices.

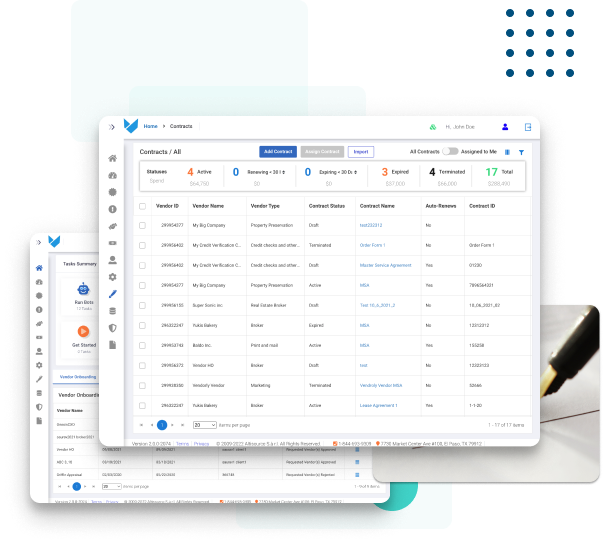

Contract Management

With Vendorly’s contract management feature, it is now easier to gain valuable insight into contract terms, performance, and spend analysis of third-party vendors.

Vendorly is a central contract repository giving you full visibility into all your vendor contracts.

Key Benefits

- Capture all vendor contracts in a single repository to help you initiate, organize, review, and monitor key contracts.

- Set up automatic notifications to avoid missing key dates in a contract’s lifecycle. Stay ahead of contract renewals and expirations to eliminate the risk to your organization.

- You’ll have a clear view of your contracts and vendors with a single centralized repository of all your contracts.

- Full reporting capabilities including intuitive reporting matrices to help you identify key spend and vendor usage patterns.

Due Diligence Reviews

Not all vendors are the same and neither is the associated risk. Vendorly offers customized levels of due diligence questionnaires and research specific to vendor type.

Vendorly can work as an extension of your organization providing you with a team of experts that can help you with the following types of verifications and reviews:

Key Benefits

- License Verification

- Insurance Verification

- Office of Foreign Assets Control (OFAC) Check

- Tax Form (W-9) Review

- Better Business Bureau (BBB) Check

- Creation of a Business Reputation

- Business Status Validation

- Consumer Financial Protection Bureau (CFPB) Check

- Due Diligence Questionnaires

- Vendor Scorecards

Third Party Originator (TPO) Oversight

It’s imperative that lenders who work with TPOs properly vet them first. Vendorly provides an award-winning solution that can help you reduce risks and increase productivity. Financial institutions and mortgage lenders use Vendorly to navigate the complex TPO vetting process and create a secure central repository for documentation — all in one place.

Key Benefits

- Avoid possible risks by vetting qualified TPOs

- Save time by accessing a single source of secure information rather than multiple sites

- Increase productivity and save administrative costs by letting us do the heavy research for you.

- Customize the TPO program to meet your approval and compliance requirements.

- Streamline the vetting process with our easy-to-use integrated automated technology.

- Qualify TPOs faster by sending and tracking in-depth electronic questionnaire packages.

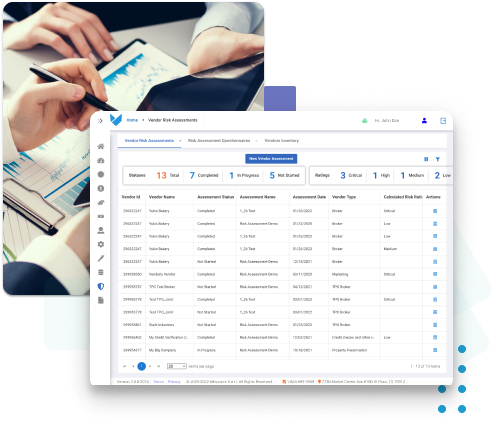

Automated Risk Assessment

Assess your vendors based on simple, standardized, and affirmative questionnaires to determine whether they require deeper due diligence. This calculated ‘Risk rating’ for each vendor also helps to streamline operational processes and substantiate the required level of your vendor risk assessments.

Key Benefits

- Self-service, on demand Risk Assessment.

- Simple, methodical, and quantifiable risk scoring for due diligence vetting and ongoing monitoring.

- Summarized, real-time data of risk assessments on all your vendors.

- Helps navigate through inherent risks at vendor engagement.

Mortgage Banking Employee Background Checks

Vendorly now offers a comprehensive Mortgage Banking Employee Background Check solution to streamline the process of performing annual re-screening of employees to mitigate risk, maintain compliance with HUD or Agency programs, and meet both state and federal audit requirements. This solution includes an Employee Search Report that features a System for Award Management (SAM) exclusionary check, Nationwide Mortgage Licensing System (NMLS) check, HUD Limited Denial of Participation search, and details on known business connections.

Vendorly also conducts specialized searches, including an Office of Foreign Assets Control (OFAC) search for matches on the Specially Designated Nationals list, using the employee’s full legal name, with results provided in PDF format. Additionally, Vendorly’s Criminal Records Check offers a thorough search of statewide criminal courts, Department of Corrections, county arrest records, and traffic violations, with detailed results also delivered in PDF format. This search does not include Federal criminal information.

Key Benefits

- OFAC (Office of Foreign Assets Control) Search

- NMLS (Nationwide Multi-state Licensing System) Search Employee

- SAM (System for Award Management, Government contract awards system) Exclusionary Search

- HUD’s Limited Denial of Participation Exclusionary List Criminal Records Check